Batelco (Ticker: BATELCO), today announced its financial results for the first nine months of 2019 (the period) and for the third quarter of 2019, the three-month period ended 30 September 2019 (Q3).

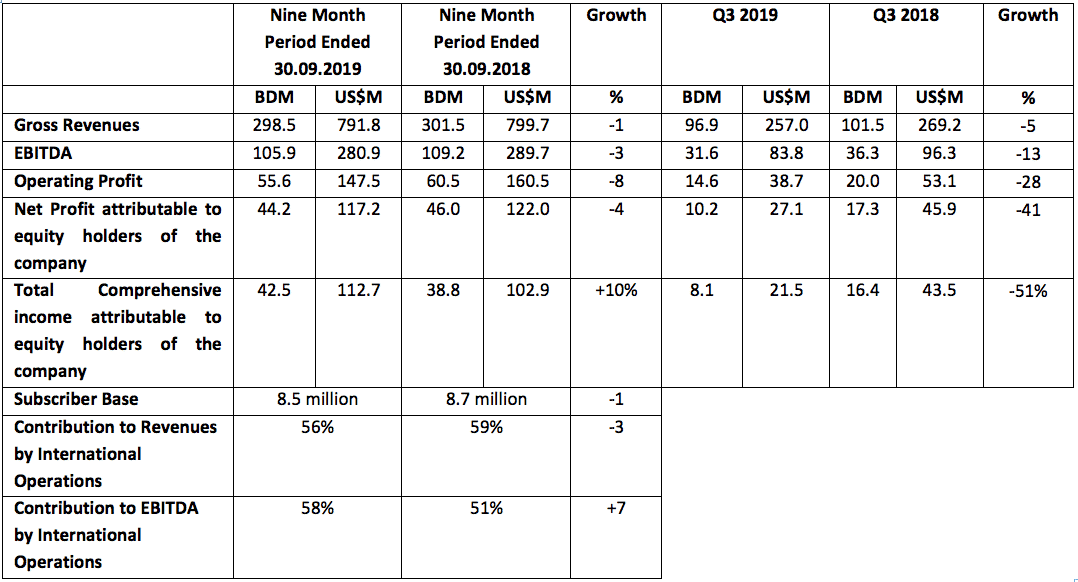

Batelco announced net profit attributable to equity holders of the company for Q3 2019 of BD10.2M (US$27.1M), a 41% decrease from BD17.3M (US$45.9M) for the corresponding period of 2018. Net profits attributable to equity holders of the company for the first nine months of 2019 of BD44.2M (US$117.2M) are down 4% from BD46.0M (US$122.0M) for the corresponding period in 2018. Earnings per share (EPS) are 6.2 fils for the third quarter of 2019 compared to 10.4 fils in Q3 2018 resulting in an EPS of 26.7 fils for the period compared to an EPS of 27.8 for the same period in 2018.

Revenues for the third quarter in 2019 decreased by 5% compared to Q3 2018 from BD101.5M (US$ 269.2M) to BD96.9M (US$257.0M). Revenues for the first nine months of 2019 were BD298.5M (US$791.8M), a decrease of 1% when compared to BD301.5M (US$799.7M) of revenues for the same period in 2018. Consolidated revenues have been impacted by the sale of Qualitynet in May 2019, whereby the company contributed an additional BD11.0M (US$29.2M) in revenues during the same period last year. Revenues in the home market of Bahrain have increased by 6% year-over-year boosted by revenues from fixed broadband, data communications and mobile, which are up year-on-year by 12%, 13% and 5% respectively.

Total comprehensive income attributable to equity holders for Q3 2019 reported at BD8.1M (US$21.5M) a decrease of 51% from BD16.4M (US$43.5M) for the third quarter of 2018. Total comprehensive income attributable to equity holders of the company is up by 10% for the first nine months of 2019 from BD38.8M (US$102.9M) to BD42.5M (US$112.7M).

Operating profit for the quarter is down by 28% to BD14.6M (US$38.7M) from BD20.0M (US$53.1M) in Q3 2018; while year-on-year operating profits decreased by 8% from BD60.5M (US$160.5M) in 2018 to BD55.6M (US$147.5M).

EBITDA for the third quarter of 2019 stands at BD31.6M (US$83.8M) compared to BD36.3M (US$96.3M) in Q3 2018, representing a decline of 13%. For the nine-month period, EBITDA decreased by 3% over the corresponding period of 2018 from BD109.2M (US$289.7M) to BD105.9M (US$280.9M) with a healthy EBITDA margin of 35%. EBITDA for the quarter was impacted by BD8.1M (US$21.5M) Life Beyond Employment (LBE) cost, which is a voluntary employee retirement programme. The programme will reduce future staff costs whilst simultaneously rewarding employees that wish to retire early. Adjusted EBITDA for the period without the LBE cost is 6% higher year-on-year.

Batelco’s balance sheet remains strong with total assets of BD964.5M (US$2,558.4M) as of 30 September 2019 compared to BD912.4M (US$2,420.2M) as of 31 December 2018, an increase of 6%. Net assets as of 30 September 2019 stand at BD496.3M (US$1,316.4M) compared to BD504.9M (US$1,339.3M) as of 31 December 2018, a decrease of 2%. The Company’s cash and bank balances are a substantial BD157.2M (US$417.0M), which reflects the interim dividend of 10 fils per share paid in August 2019. Total Equity attributable to equity holders of the company is BD459.2M (US$1,218.0M) compared to BD465.2M (US$1,234.0M) as of 31 December 2018, a decrease of 1%.

Financial and Operational Highlights

Batelco Chairman, Shaikh Abdulla bin Khalifa Al Khalifa announced the third quarter (Q3) 2019 financial results following the meeting of the Board of Directors on November 5th, at Batelco’s Hamala Headquarters.

The Chairman expressed the Board’s satisfaction with the company’s performance by announcing the financial results, saying: “We were pleased to announce revenues for the nine-month period, which are in line with the corresponding period of 2018, with the revenues positively boosted by strong performance in the home market of Bahrain, reflecting increased revenues specifically in the areas of fixed broadband, data communications and mobile.”

“One of Batelco’s most notable achievements in the third quarter of this year is the restructuring of the company and the successful completion of the separation into two independent entities, with the recent announcement of the launch of BNET, as well as the restructuring of international investments by establishing a dedicated division to focus on the investment strategy, to enhance the return on shareholder value. Accordingly, the sale of Kuwait’s Quality Net was carried out based on the changing telecommunications landscape in Kuwait.”

“Due to the absence of Qualitynet revenues, our consolidated revenues have been marginally impacted, as the subsidiary contributed BD11M during the corresponding period of 2018. However, we believe the sale came at the right time as it supports our future investment plans for Batelco and its subsidiaries and serves to optimise our portfolio of assets,” he added.

“Going forward, the Board of Directors will continue to prioritise efforts to achieve the highest possible returns for all stakeholders, while ensuring the long term success of the Company,” the Chairman said.

Batelco CEO Mikkel Vinter stated that the quarter has been marked by restructuring and reorganising management and staff and redesigning the business model and strategic direction to be prepared for the new journey ahead.

“The separation is a milestone in Batelco’s history and provides us with the opportunity to refocus on redesigning the Company’s strategy and business model to create new revenue streams such as delivering leading edge digital solutions for the business, government and consumer sectors, supported by an exceptional customer experience, while optimising cost efficiency.”

“Furthermore, we have introduced a new programme called Life Beyond Employment (LBE), which was launched with the aim of restructuring the workforce and rewarding those who have served the company over many years,” he added.

Looking Forward

Before concluding the meeting, Batelco Chairman Shaikh Abdulla extended appreciation to all the teams involved in the major restructure of Batelco.

“We have achieved a major milestone with the launch of BNET allowing both new entities to now forge ahead with establishing their individual footprints on the local and regional markets.”

“It is crucial that we remain focussed on meeting the needs of our diverse customer base, by delivering top quality and competitively priced products and solutions that prioritise their evolving requirements. We believe we have the right management and staff teams in place along with clear strategies, positioning us well for the last quarter of the year, and preparing the operational platform for 2020,” Shaikh Abdulla concluded.

This press release, along with the full set of financial statements, is available on the Bahrain Bourse website and on Batelco website, www.batelco.com