Ithmaar Holding and its wholly-owned subsidiary, Ithmaar Bank, report half-year profits

MANAMA, BAHRAIN – 7 August 2019 – Ithmaar Holding B.S.C., a Bahrain-based holding company, and its wholly-owned subsidiary, Ithmaar Bank B.S.C. (closed), a Bahrain-based Islamic retail bank, each announced their financial results for the first half of 2019 with both reporting increased profits for the period.

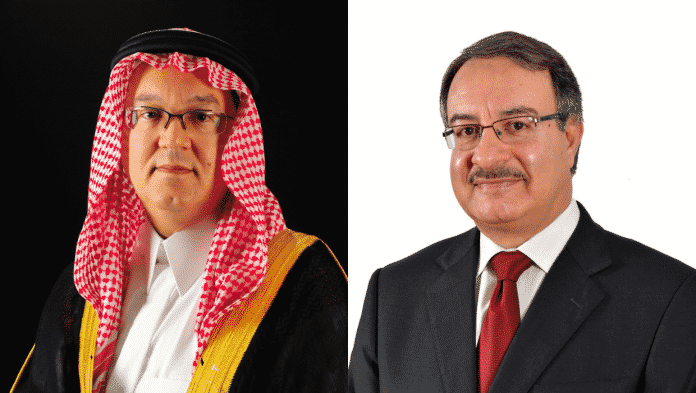

The announcement by the Ithmaar Holding Chairman His Royal Highness Prince Amr Al Faisal, who is also the Ithmaar Bank Chairman, follows the review and approval of both Boards of Directors of the consolidated financial results for the six-month period ended 30 June 2019.

Ithmaar Holding reported a net profit of US$13.03 million for the six-month period ended 30 June 2019, a 20.4 percent increase compared to the net profit of US$10.82 million reported for the same period in 2018. The net profit attributable to equity holders for the six-month period ended 30 June 2019 was US$8.37 million, a 72.5 percent increase compared to the net profit of US$4.85 million reported for the same period in 2018. Total income for the six-month period ended 30 June 2019 was US$246.66 million, a 7.5 percent increase compared to US$229.34 million reported for the same period in 2018. Operating income for the six-month period ended 30 June 2019 was US$143.98 million, a 3.2 percent decrease compared to US$ 148.68 million reported for the same period in 2018. Earnings per share (EPS) for the six-month period increased to US Cents 0.29 compared to US Cents 0.17 for the same period in 2018.

The half-year results included a net profit of US$4.41 million for the three-month period ended 30 June 2019, as compared to a net profit of US$6.01 million for the same period in 2018. Net profit attributable to equity holders for the three-month period ended 30 June 2019 was US$1.26 million, a 60.6 percent decrease as compared to the net profit of US$3.20 million reported for the same period in 2018. EPS for the three-month period decreased to USD Cents 0.04 compared to US Cents 0.11 for the same period in 2018.

Total income for the three-month period ended 30 June 2019 was US$120.69 million, a 4.8 percent increase compared to total income of US$ 115.19 million reported for the same period in 2018. Operating income for the three-month period ended 30 June 2019 was US$67.90 million, an 11.3 percent decrease compared to US$76.53 million reported for the same period in 2018.

“On behalf of the Ithmaar Holding Board of Directors, I am pleased to announce that the 2019 half-year results show continued profits, with significant increases compared to the profits reported in the same period last year,” said HRH Prince Amr. “The Company’s improved financial results reconfirms that effort to turn the group around are clearly paying off,” he said.

Ithmaar Holding Chief Executive Officer, Ahmed Abdul Rahim, who is also the Ithmaar Bank Chief Executive Officer, said the half-year results were very encouraging, with both the Company and the Bank reporting increased profits. “Ithmaar Bank’s subsidiary in Pakistan, Faysal Bank Limited (FBL), is pursuing an aggressive growth strategy and has increased its number of branches from 455 in December 2018 to 475 as on 30 June 2019. This has reflected positively on the FBL’s financial performance during the first half of 2019 but the devaluation of the Pakistan Rupee against the US Dollar has negatively impacted the Group. Pakistan Rupee has weakened by approximately 16 percent to 163 at 30 June 2019 as against 140 at 31 December 2018, contributing mainly in reduction of Ithmaar Holding’s total assets to US$7.70 billion as at 30 June 2019, a 9.3 percent decrease compared to US$8.49 billion as at 31 December 2018. This also impacted the total owners’ equity of the Company, which stood at US$93.85 million as at 30 June 2019, a 19.3 percent reduction compared to US$116.36 million as 31 December 2018,” he said.

“Ithmaar Bank’s financial results show a net profit of BD4.10 million for the six-month period ended 30 June 2019, an increase of 13.4 percent compared to a net profit of BD3.61 million for the same period in 2018,” said Abdul Rahim. “Net profit attributable to equity holders of the Bank for the six-month period ended 30 June 2019 was BD2.11 million, an increase of 53.4 percent compared to BD1.37 million net profit reported for the same period in 2018. Total income for the six-month period ended 30 June 2019 was BD79.19 million, a 7.0 percent increase compared to BD74.01 million reported for the same period in 2018. Operating income for the six-month period ended 30 June 2019 was BD40.36 million, a 4.4 percent decrease compared to BD42.20 million reported for the same period in 2018,” he said.

“The half-year results of Ithmaar Bank included a net profit of BD1.29 million for the three-month period ended 30 June 2019, a decrease of 18.4 percent compared to a net profit of BD1.58 million for the same period in 2018,” said Abdul Rahim. “Net profit attributable to equity holders for the three-month period ended 30 June 2019 was BD0.45 million, a 17.7 percent decrease compared to BD0.54 million profit reported for the same period in 2018,” he said.

“Total income for the three-month period ended 30 June 2019 was BD38.59 million, a 3.5 percent increase compared to total income of BD37.27 million reported for the same period in 2018. Operating income for the three-month period ended 30 June 2019 was BD18.94 million, a 12.5 percent decrease compared to Operating income of BD21.63 million reported for the same period in 2018,” he said.

“Ithmaar Bank’s balance sheet has reduced by 9.4 percent with total assets at BD2.83 billion as at 30 June 2019, compared to BD3.13 billion as at 31 December 2018,” said Abdul Rahim. “Total owners’ equity stood at BD76.20 million as at 30 June 2019, compared to BD85.39 million as 31 December 2018, resulting mainly from the devaluation of Pakistan Rupee. ” he said.

“Despite challenging market conditions, the Bank increased its liquid assets by 21.6 percent to BD368.69 million as at 30 June 2019, compared to BD303.19 million as at 31 December 2018,” said Abdul Rahim. “This improved liquidity reflects the Bank’s prudent financial policies and its ability to adapt to market conditions,” he said.

Recently, Ithmaar Bank was named “Best Bank for Personal Finance in Bahrain” by the World Union of Arab Bankers (WUAB) at a high-profile ceremony hosted in Beirut, Lebanon, and attended by senior bankers from across the Middle East. Ithmaar Bank earned the prestigious award following a comprehensive selection and review process that was conducted by a committee of high-level economists and banking professionals, as well the research department of the Union of Arab Banks (UAB) and the WUAB.