The Information & eGovernment Authority (iGA) announced the launch of its eWallet. A new online payment method for government eServices. The eWallet is being made available in cooperation with The BENEFIT Company. It runs the Credit Reference Bureau network and provides the electronic funds transfer system between banks and CrediMax, a pioneer in credit card and payment gateways.

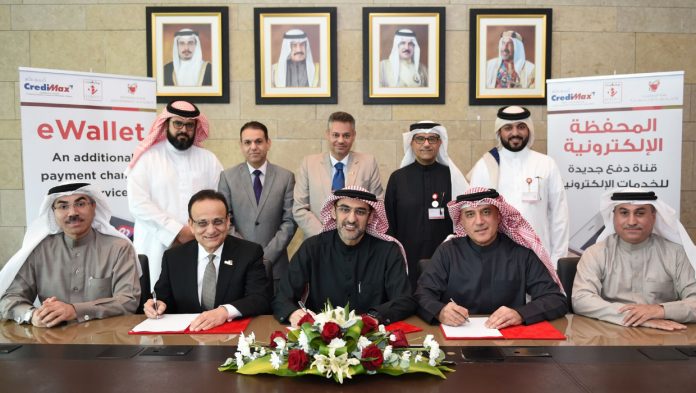

The announcement was made during a meeting between iGA Chief Executive Mohammed Ali AlQaed, BENEFIT CEO Abdulwahid Janahi, and CrediMax Chief Executive Yousif Ali Mirza at iGA’s headquarters in Muharraq, which was also attended by iGA Deputy Chief Executive of Electronic Transformation, Dr. Zakareya Ahmed AlKhajah and other executives from the partnering entities.

AlQaed stated that the eWallet was created by iGA to complement its existing smart payments program. They seeks to continuously improve it. “The new eWallet is in accordance with our strategy to offer comprehensive digital government eservices to the public across a range of channels, while remaining committed to the highest standards of security and privacy. Our cooperation with the private sector is a realization of the vision of the Kingdom’s senior leadership, which is aimed at encouraging businesses to take the lead in the ICT sector, with the government playing the role of regulator.”

AlQaed expressed his gratitude to BENEFIT and CrediMax for their continuous cooperation with the Authority in offering payment solutions for digital services.

BENEFIT

BENEFIT CEO, Abdul Wahid Janahi stated that the company greatly values its ongoing cooperation with the iGA. It comes within the framework of a partnership between the two organizations that includes several joint initiatives. “The enpansion of payment options available through BenefitPay continues. Our goal is to provide innovative electronic payment options. It will reduce the need for physical cash translations, thereby contributing to the government’s national plan to promote online services. We would like to see a future in which electronic payments are central to the culture and financial infrastructure of the country.”

Credimax

CrediMax CE Yousif Ali Mirza said that he was happy to continue to develop CrediMax’s effective partnership with the iGA. Its cooperation with BENEFIT by discussing ways for the organizations to work together. They will provide innovative solutions that contribute to the national economy. “This joint initiative is in line with our vision to provide an advanced digital environment. It will offer customers easy and convenient payment options.”

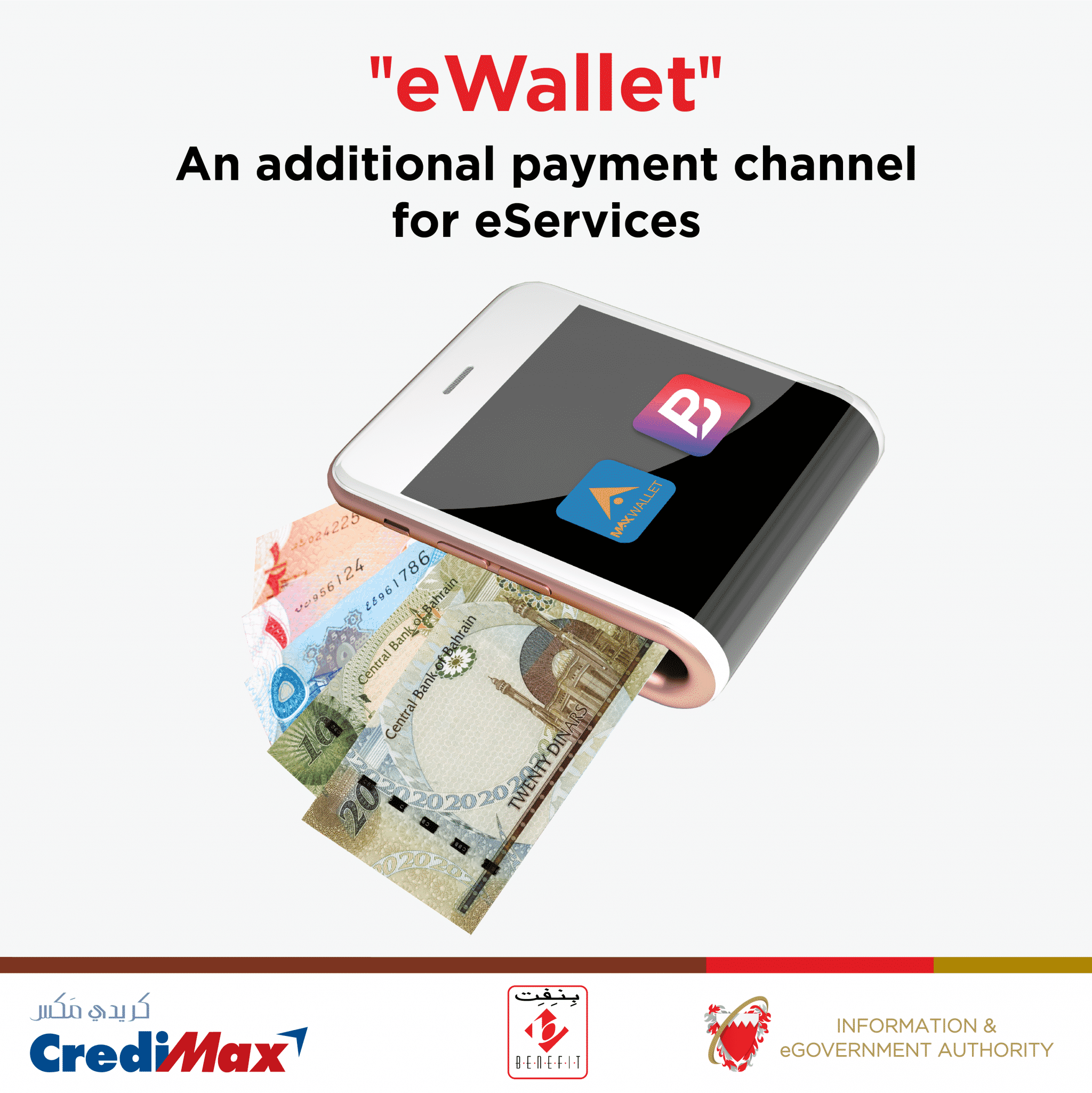

The eWallet is the latest addition to a range of payment options for iGA government eServices, including credit and debit cards. To pay by eWallet, users can scan the QR Code that appears on the payment page of the service next to the other payment options.

The new payment channel is currently available for approximately 20 eServices via the National Portal, bahrain.bh. Notable among these are payments for traffic violations, ID card services, University of Bahrain book purchasing, and school student report card services. It will be available for other services on the National Portal in the near future. Online transactions via the eWallet are faster than payment methods. These don’t rely on cards, which require inserting card numbers with every transaction. Users can also review their previous transactions via the eWallet’s log.

Steps for eWallet benefits

To benefit from the service, follow these steps: Download the BenefitPay or MaxWallet apps onto your smartphone. Create an eWallet account by filling in the details. Then follow the steps until reaching the payment page, where regular payment options such as debit and credit cards will appear. The eWallet will be available as a third option. When choosing to pay by eWallet, users must choose either BenefitPay or MaxWallet. Depending on the app on their smartphones, where they will see the QR Code. Users must choose ‘Scan Code’ then ‘Agree’ to complete the payment process using smartphones. When using other smart devices, scan the QR Code using the camera. This will open the payment app. Then, press ‘Agree’ to complete the transaction.